The Benefits/Costs of Low Interest Rates

For everything on this planet there is a market price, including interest; i.e., the cost of borrowing money.

There are three components of interest rates:

- The originary rate, or the rate needed to turn someone from a spender into a saver; i.e., from a consumer into a lender.

- The debtor’s risk premium, or the amount of compensation needed to cover the risk of default by the borrower, and

- The inflation premium, or the amount of compensation needed to cover the risk that the lender will be paid back with money of a lesser purchasing power.

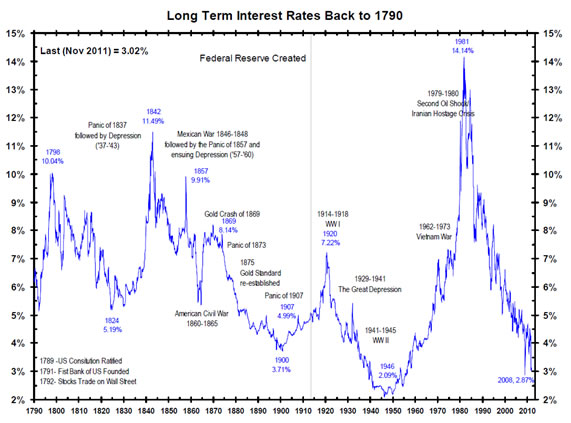

Throughout history, the price assigned to each of these components has varied depending on the times; i.e., whether there has been a war, a central bank with a money monopoly, or some sort of natural disaster such as drought, for example.

During the late 1970s, the United States entered a new era of money printing and interest rate manipulation after the Federal Reserve Bank closed the gold window and began printing un-backed Federal Reserve Notes in earnest. To gain control of the resulting inflation, Fed Chairman Paul Volcker raised the fed funds rate to a high of 20%, in June 1981. Long-term rates also rose to a high of 14.14% (see above). Not surprisingly, a recession ensued, but the rising inflation rate was halted and interest rates began their long decline. The lesson the Fed learned from this experience was that high interest rates cause recessions and low interest rates encourage borrowing and (hopefully) growth.

In its own words, the Fed has learned that low interest rates “help households and businesses finance new spending and help support the prices of many other assets, such as stocks and houses.” What the Fed has overlooked is that spending, in itself, is not necessarily good. It can also be wasteful and misguided.

By keeping interest rates low for an extended period of time, businesses and households are encouraged to borrow more money, and they can use that money to expand their operations. This is true, and in many cases, good.

Nevertheless, over time, the benefits of low interest rates diminish and some potential problems can arise:

- Some businesses may borrow too much, become over-extended and either can’t afford to repay the funds (resulting in bankruptcy), or are bought out by someone else with more cash and/or less debt.

- When money is easy to borrow, borrowers tend to bid up prices of goods, such as housing and stocks, thus creating a bubble in some industries.

- At some point, when artificially-maintained low interest rates rise to a market rate, borrowers who cannot make their rising interest payments (are over-extended) fail or sell out. If enough people fail, a banking crisis results.

- People may invest more heavily in things that are easier to borrow against and forgo investing in things that are more difficult to borrow funds for…for example, they might invest in housing instead of manufacturing, or in military suppliers rather than farming.

In short, mal-adjustments occur throughout the economy. Booms and busts follow. Income inequality grows and the middle class disappears.

As the Fed manipulates interest rates and the money supply, at best, businesses and households are whip-sawed in their investment decisions, and at worst, they are bankrupted or impoverished by the lack of interest paid for their savings. When retirees don’t earn a market rate on their life savings, they become poor and dependent upon government programs. And when the government has taken everything from the productive members of society, they won’t be able to support all the dependents. When the government fails to redistribute the wealth (because it’s all gone), the people will cry out for a dictator to make things right. I’m not looking forward to that day.

Robert Jackson Smith